If you are cash is among the best an easy way to fund good house flip, very house flippers do not have the needed financing so you can flip a great house only using bucks and will need to use some type from financial support.

But what types of financial support is obtainable to house flippers and do you require more conventional kinds of financial support instance a great old-fashioned or FHA loan so you’re able to flip a house?

Domestic flippers will normally have fun with a quick-term resource, such an arduous currency financing or individual currency. not, you are able to explore more conventional different capital including just like the a conventional loan or even a keen FHA mortgage so you’re able to flip a home with some limitations and you will caveats.

Thus let us examine how you can flip good family playing with a conventional financing and you can what some of those constraints and caveats might possibly be.

Tips Flip a house having a normal Loan

When you are turning a property that have a traditional loan is achievable it requires that approach the home flip into the a unique ways than if you decide to fool around with way more brief-title investment otherwise bucks to cover the newest flip.

To get an excellent Flip having a traditional Mortgage

This is because the typical loan process will take anyplace of 30 in order to 45 days to-do on account of every necessary steps and you will records, and make an easy purchase challenging or even impossible.

And when in search of a house in order to flip when using antique investment, you ought to come across conventional domestic providers including holder-residents which do not need and they are maybe not looking for a simple deals.

And, if you intend to utilize a conventional loan to acquire a good house flip you will need to has very good credit once the better because the some funds towards deposit.

Because so many old-fashioned funds will require a credit history out-of at minimum 620 at least a good step 3% downpayment.

Antique Finance and you will Assets Standing

One of the large great things about using an arduous money loan otherwise personal money to invest in a great flip would be the fact there are constantly few or no property status criteria.

Making it possible for property flipper to order a significantly wide a number of attributes including those that are in need of detailed repairs. That may be the fresh new home towards the steepest coupons therefore the ideal potential earnings .

That have a normal financing, however, there’ll probably feel minimum assets standing standards and doing work and operational auto mechanics and resources, a drip-100 % free roof perhaps not within end from lives, and you will a termite-100 % free property.

So if you decide to play with a traditional mortgage so you’re able to flip property you ought to manage property that primarily you need makeup really works and you will updating like the latest floor or paint.

And be from properties that will require comprehensive functions otherwise big build as these variety of attributes will more than likely maybe not meet conventional loan minimum assets status standards.

Possessions Rehabilitation that have a traditional Home loan

If you are planning into using a normal financial toward purchase of brand new flip, one nevertheless simply leaves issue regarding how you plan to spend on rehabilitation of the home.

This is exactly an effective solution, because it makes you perform position and you can fixes to your assets without the need to remove the next financial or come with your own money.

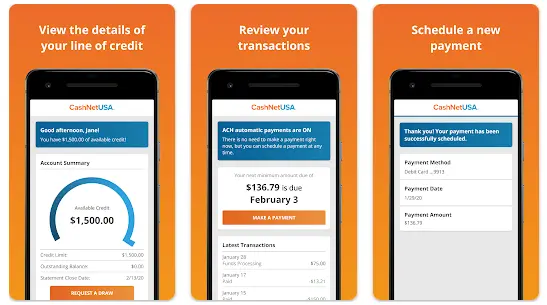

Others choice is to make use of fundamental traditional funding and only finance the fresh new rehab on your own if you are paying bucks for the updates and fixes over time or having fun with handmade cards otherwise an unbarred range from credit.

Conforming and Low-Compliant Old-fashioned Finance

But not, now most money are often conforming on account of exposure-averse lenders and the highest second mortgage business that may so much more readily purchase compliant finance because they’re thought down risk.

When you are a new comer to mortgage brokers or mortgages, a compliant mortgage is actually financing that suits certain direction or minimum requirements place from the Federal national mortgage association and you will Freddie Mac.

This type of lowest mortgage criteria usually become the very least credit history having brand new debtor, the very least loans so you’re able to earnings proportion towards borrower, work standards, and also occupancy requirements.

The reason why so it issues so you can property flipper trying use a normal financing would be the fact such standards and you can minimum requirements have good influence on your capability to find the mortgage, in addition to impression your have fun with and you will capacity to offer the newest home.

When you propose to use a conventional mortgage otherwise any different kind out-of traditional investment, you really need to determine if you’ll find one constraints on the upcoming income of the home, pre-commission charges, or occupancy conditions.

As is the fact which have FHA money, and this need the debtor to reside in the home to have in the the very least 12 months because their number 1 home.

Having fun with a conventional Loan having a real time-In the Flip or Slow Flip

Antique money are best suited in order to either a real time-within the flip or sluggish flip as these types of flips always support a slow closing techniques and you will involve lengthier day frames.

How to Be eligible for a conventional Mortgage?

If you intend to make use of a conventional financial to buy property flip you initially need certainly to qualify for the regular mortgage, that will be tricky for some consumers depending on their earlier credit history and debt in order to income proportion.

- No big borrowing circumstances such as bankruptcies or foreclosures.

- At least credit rating of at least 620 depending on the financial obligation in order to earnings proportion therefore the loan amount.

- Personal debt in order to money proportion of just about 43%.

- Advance payment of at least 3%. not, first-day homeowners will require 5% off and will feel even higher if you’re getting the assets just like the an additional household otherwise investment property.

- Restrict loan amount of $510,eight https://paydayloancolorado.net/black-hawk/ hundred otherwise quicker otherwise $765,600 or quicker inside large-pricing elements.

What’s the Greatest Sort of Financing to Flip a property?

An educated particular loan so you’re able to flip a house with is actually a short term financing like an arduous currency mortgage .

As they promote short and short-term resource for the purchase while the rehab of the house.

not, it’s important to fully understand this new fine print ones sorts of short-title difficult money loans, as they can usually have very high will set you back with upfront things and additionally high-rates of interest out of 11 if you don’t 18%.

Additionally, these fund normally have go out limitations connected to him or her, requiring the mortgage are paid inside a certain amount of your time.

Assuming these date limits is actually exceeded, they often leads so you can high penalties and you will big charges, that will include large can cost you into mortgage.

Differences between a conventional Loan and you will a hard Money Financing

You’ll find plenty of differences between a difficult money financing and a traditional mortgage and these differences might have a good impact on the mortgage and also the flip.

Would like to know ideas on how to flip property in just 10K? Listed below are some our writeup on Simple tips to Flip a home with only $10,one hundred thousand .