- What is a-1% down payment financial?

- Advantages and disadvantages

- How to get a 1% deposit financial

- Selection

Associate hyperlinks to your circumstances in this post come from lovers you to definitely make up you (select our marketer revelation with your set of lovers for more details). Yet not, our feedback try our personal. Observe i speed mortgage loans to write objective studies.

But given that buying property only has obtained smaller sensible inside recent years – and you may financial pricing keeps leaped, lenders have seen to acquire imaginative in order to broaden its pool off prospective individuals.

This new 1% down mortgage is one of these types of creative steps. As the term means, allowing borrowers get into property with just 1% of one’s price and will generate homeownership so much more accessible having of many.

But before you utilize one to (or search for 1), you should see just how these types of mortgage loans performs and you can whether they make sense to meet your needs and you may future plans. Here is what you need to know.

Usually, a decreased advance payment you may make towards a traditional financial was step three%. Some authorities-supported mortgage loans allow it to be zero downpayment, but these financing are merely available to individuals which satisfy specific qualifications criteria (like becoming an army associate otherwise veteran, for example).

A-1% off financial was financing that enables you to create good down-payment regarding simply step 1% of one’s residence’s purchase price. So, when your household costs $3 hundred,000, the downpayment might possibly be just $step three,000. That is enough offers as compared to antique step 3% you prefer (that would amount to a good $nine,000 downpayment)

Traditional financing

Extremely 1% off mortgage loans are traditional funds, which happen to be financing backed by Federal national mortgage association and Freddie Mac computer. Theoretically, these wanted an excellent step three% lowest down payment, and when a lender now offers a-1% advance payment traditional financing, they are also giving so you’re able to ft the balance on left 2%.

Throughout the a lot more than analogy, that’d imply you might shell out $3,000 of one’s deposit, and your lender manage protection the remaining $6,000.

Recommendations applications

Some step one% down-payment mortgages are supplied owing to special community programs otherwise loan providers that provide down-payment direction. With the help of our, the applying otherwise lender also provides a grant toward left dos% of one’s down payment or, regarding loan providers, provides loans with the the closing costs and come up with upwards for them.

A 1% downpayment home loan is also voice very nice, however, there are disadvantages also. Here you will find the pros and cons to adopt before taking that of them financing aside.

Pros

- Straight down hindrance to help you entry: Whether your loan requires just 1% off, possible spend less to view a property. This could along with free up more money move for your household and you can convenience financial be concerned.

- Less homeownership: You simply will not need to purchase as much ages protecting right up when need merely step one% down. This could will let you pick a house far earlier than asked.

- Potential for admiration: If you get on the property before, you really have additional time to build guarantee to check out profit from the house’s appreciation.

Downsides

- Highest rates of interest: As you have less financial epidermis throughout the games, 1% off mortgage loans are slightly riskier than just financing with big off payments. Lenders could possibly get compensate for this having large interest levels.

- Personal home loan insurance policies: You’ll be able to constantly have to pay to have individual home loan insurance (PMI) after you generate a small down payment. So it increases your own monthly payment.

- Limited lender alternatives: Few loan providers promote step 1% off mortgages. You may also just have several people to select from.

Envision a-1% down payment mortgage was the right path to help you homeownership? This is how to order a property having step 1% down.

Pick an using bank

Browse lenders, and look having financial institutions and you can borrowing unions towards you. Not many financial institutions give such, so you may need certainly to check with specialty lenders otherwise on line mortgage people for the most possibilities. Be sure to enquire about basic-time homebuyer software, also, as these tend to feature reduce commission criteria.

See eligibility criteria

Once you get a hold of a lender, be sure this new being qualified requirements you’ll need to meet. This type of includes the absolute minimum credit history, a maximum loans-to-earnings ratio, and you may a max financing-to-worth ratio.

Speak about assistance apps

It’s also possible to check out assistance applications that offer features or credits that can help along with your down payment https://clickcashadvance.com/installment-loans-nc/hamilton challenges. Talking about have a tendency to offered compliment of regional houses divisions or community organizations.

If you don’t be eligible for one of those step 1% off mortgages or commonly sure they’re the right fit for your, there are plenty of almost every other affordable features of low if any off payments.

FHA financing

You can find low-down percentage mortgages supported by the brand new Government Homes Management. They need a down-payment off simply step three.5% and come with smaller strict borrowing from the bank criteria, as well as a minimum credit rating from only 580.

Virtual assistant loans

These types of mortgage loans are supported by new Company of Experts Circumstances and you will are available to newest servicemembers and you can veterans whom satisfy lowest services criteria. Needed no down payment without financial insurance policies.

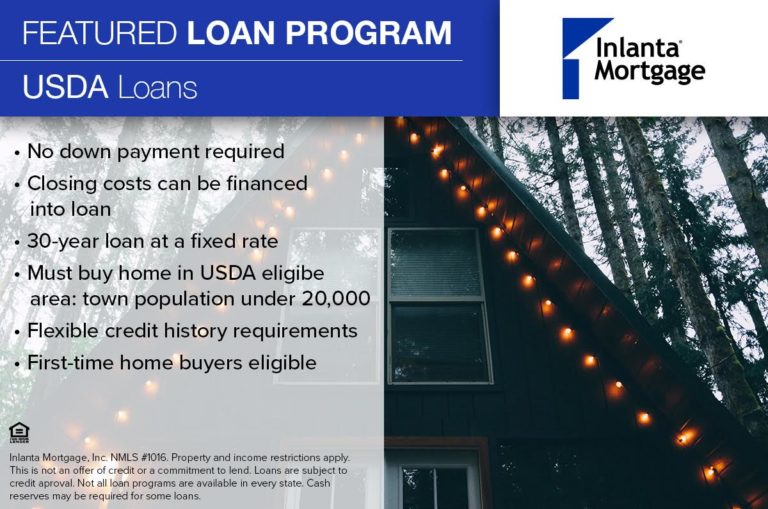

USDA money

These are mortgages guaranteed by the Company away from Farming. It permit reasonable-to-middle-income group consumers within the eligible rural or residential district components to purchase a house no currency down. You can utilize new USDA’s qualifications chart to find out if you will be during the a selected « rural » city.

If or not a 1% deposit mortgage makes sense hinges on your individual circumstances. For the one hand, you can aquire to your homeownership quicker and start building guarantee before. To the disadvantage, whether or not, you will probably spend high financial cost and certainly will create personal home loan insurance coverage (PMI) towards monthly premiums.

Usually, PMI needs with a-1% down-payment, but some lenders may offer possibilities or bank-paid back mortgage insurance policies. When you do are obligated to pay PMI, possible pay it element of your monthly payment if you don’t arrive at at least 20% guarantee of your property. When this occurs, you could potentially get hold of your servicer to terminate PMI.

The potential risks from a-1% downpayment is high interest levels and you will a much bigger monthly payment, since you might need individual home loan insurance rates.